The Albanese Government will deliver two more tax cuts to every Australian taxpayer in 2026 and 2027, adding to the first round that Labor delivered in July last year.

Every Australian taxpayer gets another tax cut from next year – all 14 million, not just some.

This will give a top up to every taxpayer, right up and down the income scale.

Labor’s new tax cuts are modest but they will make a difference.

Combined with Labor’s first round of tax cuts, the average tax cut is expected to be around $43 per week or more than $2,200 in 2026-27, and around $50 per week or more than $2,500 in 2027-28.

It’s a bit of extra help for every taxpayer and it tops up our tax cuts that started flowing on 1 July 2024.

Labor’s new tax cuts will be phased in over two years, ensuring our fiscal settings are consistent with inflation remaining sustainably in the target band.

Last year, we cut two rates and lifted two thresholds to deliver tax cuts for all Australian taxpayers, including around three million people who would have missed out completely under Scott Morrison’s policy from before the election.

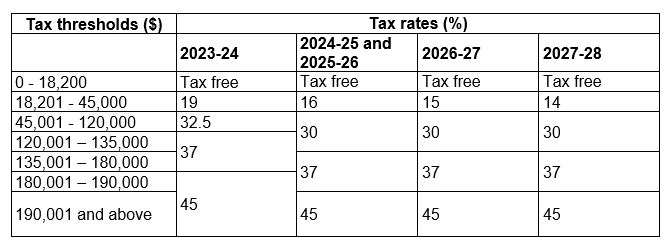

The Albanese Labor Government will cut income taxes further over two years:

- From 1 July 2026, we will reduce the 16 per cent tax rate to 15 per cent (for income between $18,201 and $45,000).

- From 1 July 2027, this tax rate will be reduced further to 14 per cent.

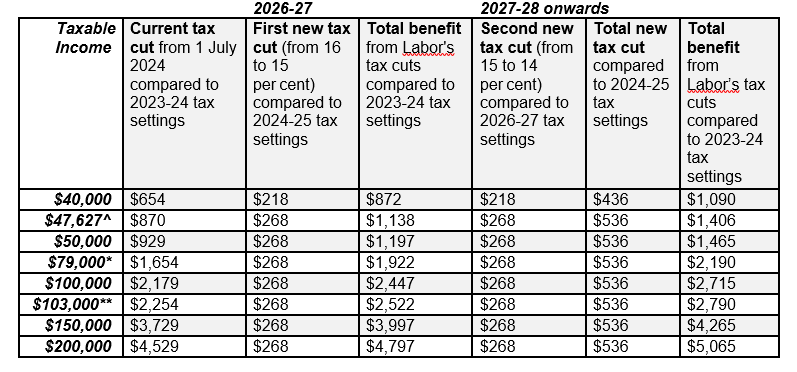

As a result of these changes:

- All 14 million Australian taxpayers will receive a tax cut, on top of our tax relief that’s already rolling out.

- Every Australian taxpayer earning above $45,000 (around 80 per cent of taxpayers) will get an extra tax cut of $268 in 2026-27 and $536 from 2027-28, compared to 2024-25 settings.

- A worker on average earnings ($79,000) will get an extra tax cut of $268 in 2026–27 and $536 per year from 2027–28.

- Every Australian taxpayer earning between $18,201 and $45,000 will get an extra tax cut of up to $268 in 2026-27 and up to $536 from 2027-28, compared to 2024-25 settings.

- A person earning $40,000 will get an extra tax cut of $218 in 2026-27 and $436 every year from 2027-28.

Combined with Labor’s first round of tax cuts:

- The average tax cut is expected to be around $43 per week or more than $2,200 in 2026-27, and around $50 per week or more than $2,500 in 2027-28, compared with 2023-24 settings.

- An average earner will receive total tax relief of $1,922 in 2026–27 and $2,190 per year from 2027–28, compared to 2023–24 tax settings.

- The average income earner will pay around $30,000 less in tax to 2035-36, compared to 2023-24 settings.

The Government’s personal income tax reforms lower the first tax rate from 19 to 14 per cent, the second tax rate from 32.5 to 30 per cent, and lift two thresholds.

Our changes to the bottom tax rate under the new tax cuts will bring this rate to its lowest level in over 50 years.

In addition, the Government will increase the Medicare levy low-income thresholds from 2024-25.

This will benefit more than a million Australians, ensuring people on lower incomes continue to pay a reduced levy rate or are exempt from the Medicare levy.

Labor’s tax cuts return bracket creep, increase the financial rewards from work and boost labour supply.

Whether you’re a truckie, a teacher or a tradie, whether you’re in manufacturing, mining or the care economy, you will earn more and keep more of what you earn.

Our new tax cuts for every Australian taxpayer come on top of our substantial and responsible cost of living relief including:

- Cost of Living Tax Cuts from 1 July 2024;

- Energy bill relief for every household and for small businesses;

- Strengthening Medicare with more bulk billing;

- Cheaper medicines, with a script to cost Australians no more than $25 under the Pharmaceutical Benefits Scheme;

- Cheaper child care;

- Cutting student debt and repayments;

- Free TAFE;

- Increased rent assistance and working age payments;

- Building more homes;

- Higher wages.

The changes to the personal income tax system will cost $17.1 billion over the forward estimates.

The increase to the Medicare levy low-income thresholds will cost $648 million over the forward estimates.

The Albanese Government’s responsible economic and fiscal management has allowed us to fund important priorities like this tax relief for every Australian taxpayer.

Our economic plan is all about helping Australians earn more and keep more of what they earn and that’s what these tax cuts will help to achieve.

To find out how much the Government’s tax cuts will benefit you, use the calculator on the Budget website: budget.gov.au

Table 1: New personal tax rates and thresholds

Table 2: Summary of tax benefits

^ The national minimum wage is $47,627, set by the Fair Work Commission under the Fair Work Act as of 1 July 2024.

* Annualised average weekly earnings is around $79,000, based on $1,510.90 per week in November 2024 (ABS data release), which captures average gross wages across all employees, including full- time and part-time workers.

** Average ordinary full-time earnings is $103,000, based on $1,975.80 per week in November 2024 (ABS data release), which captures average gross wage income across full-time employees only, and excludes any income earned from overtime.